Historical Housing Market Trends

by Brian Huie, March 13, 2025

Why Market News is Always Behind - And What That Means to You

Most market updates you see—from news, social media, and even some realtors—are already outdated. Here’s why even the most well-intentioned experts can miss the mark:

Closed sales reflect deals made 30+ days earlier.

Market stats take 1-2 weeks to compile and publish.

News outlets and blogs report on those stats weeks later.

Social media influencers and slow reporters keep recycling the info for months.

A November listing could close in December, be reported in January, and still be trending on social in March.

The good news? We [NWMLS Realtors] now track LIVE pended data—so you don’t have to rely on stale reports. Check out my Seattle Monthly Market 3-Minutes for the most up-to-date insights. Looking for long-term trends? Keep reading for a decade of market history.

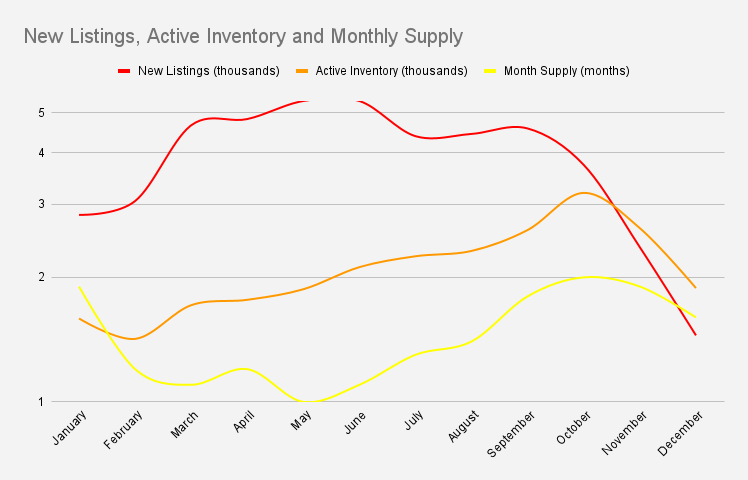

Historical Trends

New Listings most frequent March-October

Most homes to choose from in October

Month Supply is the time it takes for the current active listings to deplete at the current sales pace. Very low in spring and summer despite having the most new listings, indicating higher buyer activity

New loan applications peak mid to late January each year.

Yellow markers indicate the highest point of applications in each year (January); Blue marker is the last reported data for that year (End of December)

National average time a buyer closes after their most recent preapproval is 50-days with a 45 day transaction. It is common in Seattle Greater to search for 3-9 months and transact in 15-28 days.

Average Fixed 30 Year Mortgage Rates

Sales Price to Original Listing Price to Time on Market

Sale Price/Original Listing Price is highest in May and lowest in January but is a 2-6 week lagging indicator based on a successful sale and doesn’t include the original prices of prior unsuccessful listings (a home may have taken several listings over many months to sell).

Average time on market lowest in May, highest in December and doesn’t include the time a listing has spent on market in a prior unsuccessful listing (a home may have taken several listings over many months to sell).

Brian’s Client Q&A on rates:

Q: If fed rates don’t affect mortgage rates, what does?

A: 10Y Treasury bond, Inflation/CPI/Jobs Reports, World Events.